| ● | We use for benchmarking purposes, the design of our annual cash incentiveperformance and long-term incentive programs, and our executive employment agreements. For its compensation consulting in 2015, we paid Deloitte Consulting $162,797.In 2015, our financial management separately engaged affiliates of Deloitte Consultingreview process to perform other services involving internal controls auditing, tax consulting and acquisition due diligence. For these non-compensation related services, we paid Deloitte $2,988,411. The Compensation Committee did not approve these charges prior to their incurrence, but considered them in connection with Deloitte Consulting’s retention for 2016. Given the nature and scope of these other services, the Compensation Committee does not believe this work had any impact on the independence of our independent consultant.

Benchmarking and Survey Data

In determining total compensation levels for our NEOs, the Compensation Committee reviews market trends in executive compensation and a competitive analysis prepared by Deloitte Consulting, which compares our executive compensation to both the companiesassess performance in the comparator group described belowyear and allocate greater reward to broader market survey data. The Committee also considersthose who deliver the highest performance relative to other available market survey data on executive compensation philosophy, strategymembers of a particular team; and design. The Company’s compensation philosophy is to target base salaries at the 50th percentile of the competitive market. Individual executives may have base salaries above or below the target based on their individual performances, internal equity and experience. As discussed above, at-risk incentive compensation components have the potential to reward our executives at levels above industry medians, but only when the Company is outperforming the industry.

The Committee chose our comparator group from companies in the primary industry segments in which the Company operates and competes for talent.

The comparator group companies for 2015 were as follows:

| | | | | Acuity Brands, Inc.

| | Curtiss-Wright Corporation | | Regal Beloit Corporation | Amphenol Corporation

| | General Cable Corporation | | Roper Industries, Inc. | Anixter International Inc.

| | Hexcel Corporation | | Viavi Solutions Inc. | A.O. Smith Corporation

| | Hubbell Incorporated | | Wesco International, Inc. | Carlisle Companies Incorporated

| | IDEX Corporation | | |

ISS

| ● | We provide honest and Glass-Lewis independently develop and publish peer groups that they usetimely feedback to analyze our compensation. It is noteworthy that of the 14 companies in our comparator group, 12 were chosen by ISS, Glass-Lewis, or both, as appropriate peer companies. The Committee considers the comparator group competitive pay analysis and survey data as non-determinative data points in making its pay decisions. The approach to pay decisions is not formulaic and the Committee, basedeach other on advice from Deloitte Consulting, exercises judgment in making them.Each year, the Committee reviews the performance evaluations and pay recommendations for the named executive officers and the other senior executives. The Compensation Committee, with input from the Board, meets in executive session without the CEO present to review the CEO’s performance and set his compensation.

In its most recent review in February 2016,opportunities to continuously improve, so that everyone has the Committee concluded thatopportunity to be the very best at what they do.

|

We believe that this philosophy has provided an appropriate balance to drive continuous improvement while retaining high performers through challenging times. More importantly, we believe the incentives we provide for achievement without rewarding under-performance contributes to our industry-leading employee engagement while aligning the interests of our managers closely with those of our customers and investors. D. Compensation Design Role of Compensation Consultant Following an analysis based on rules promulgated by the NYSE, the Compensation Committee retained Meridian Compensation Partners LLC (“Meridian”) as its independent compensation consultant during 2020. Meridian reported directly to the Committee. The Committee generally relies on the independent compensation consultant to provide it with comparison group benchmarking data and information as to market practices and trends, and to provide advice on key Committee decisions. In 2020, Meridian provided advice to the Compensation Committee and management in connection with the composition of peer companies we use for benchmarking purposes, the design of our annual cash incentive and long-term incentive programs, and our executive severance and retirement plans. Benchmarking and Survey Data In determining total compensation levels for our NEOs, the Compensation Committee reviews market trends in executive compensation and a competitive analysis prepared by the independent compensation consultant, which compares our executive compensation to both the companies in the comparator group described below and to broader market survey data. The Compensation Committee also considers other available market survey data on executive compensation philosophy, strategy and design. The Company’s compensation philosophy is to target base salaries at the 50th percentile of the competitive market. Individual executives may have base salaries above or below the target based on their individual performances, internal equity and experience. As discussed above, at-risk incentive compensation components have the potential to reward our executives at levels above industry medians, but only when the Company is outperforming the industry. The Compensation Committee chose our comparator group from companies in the primary industry segments in which the Company operates and competes for talent. The comparator group companies for 2020 were as follows: | | | Acuity Brands, Inc. | CommScope Holding Company, Inc. | Regal Beloit Corporation | Amphenol Corporation | Curtiss-Wright Corporation | Rexnord Corporation | Anixter International Inc. | Hexcel Corporation | Roper Technologies, Inc. | A.O. Smith Corporation | Hubbell Incorporated | Viavi Solutions, Inc. | Carlisle Companies Incorporated | IDEX Corporation | Wesco International, Inc. |

| | Page 22 | Belden Inc. 2021 Proxy Statement |

The Compensation Committee considers the comparator group competitive pay analysis and survey data as relevant, but non-determinative data points in making its pay decisions. The approach to pay decisions is not formulaic and the Committee, based on advice from the compensation consultant, exercises judgment in making them. Each year, the Compensation Committee reviews the performance evaluations and pay recommendations for the named executive officers and the other senior executives. The Compensation Committee, with input from the Board, meets in executive session without the CEO present to review the CEO’s performance and set his compensation. In its most recent review in February 2021, the Compensation Committee concluded that the total direct compensation of executive officers, with respect to compensation levels, as well as structure, are consistent with our compensation design and objectives. V. 2020 Compensation Analysis A. Base Salary Adjustments Salaries of executive officers are ordinarily reviewed annually and at the time of a promotion or other change in responsibilities. Increases in salary are based on a review of the individual’s performance against objective performance measures, the competitive market, the individual’s experience and internal equity. For executives who earn a composite individual performance score of 0.91 or more, base salaries may be adjusted using a merit salary increase matrix, discussed below. An executive who scores less than 0.91 and fails to improve his or her performance may be subject to disciplinary action, including dismissal. The executive is scored on our merit salary increase matrix that is annually reviewed by the Committee and, if appropriate, revised to reflect the competitive market, based on the salary survey data noted above. The executive’s salary is classified based on three categories: below market, market and above market. Company-wide, the ranking system, which assigns personal performance factors ranging from 0.5 to 1.5, is designed to take the form of a normal distribution. However, given the uncertainty facing the Company in early 2020 when annual compensation increases are customarily awarded, no NEOs or other Belden associates received annual merit increases in 2020. Instead, Mr. Stroup’s salary was reduced by 50% for the period between May 1, 2020 and December 31, 2020, Mr. Vestjens salary was reduced by 30% during the period between May 1, 2020 and his promotion to President and Chief Executive Officer on May 21, 2020, at which time his salary was reduced by 50% through December 31, 2020. The other NEO’s salaries were reduced by 30% for the period between May 1, 2020 and December 31, 2020, and other Belden associates with base salaries exceeding $100,000 experienced reductions in salary of between 10% and 20% for the period between July 1, 2020 and December 31, 2020. Base salaries were restored to normal levels as of January 1, 2021, and merit increases will be reevaluated during 2021 consistent with past practice and the guidelines described herein. | | | | | | | | | | | | | | | 5/1-5/21/2020 Salary | | | 5/21-12/31/2020 Salary | | Officer | | 1/1/2020 Salary | | | (annualized) | | | (annualized) | | Mr. Stroup | | $ 927,000 | | | $ 463,500 | | | $ 250,000 | | Mr. Vestjens | | $ 525,000 | | | $ 367,500 | | | $ 375,000 | | Mr. Derksen | | $ 584,490 | | | $ 409,143 | | | $ 409,143 | | Mr. Anderson | | $ 381,260 | | | $ 266,882 | | | $ 266,882 | | Mr. Chand | | $ 460,000 | | | $ 322,000 | | | $ 322,000 | | Mr. McKenna | | $ 388,040 | | | $ 271,628 | | | $ 271,628 | |

| | Belden Inc. 2021 Proxy Statement | Page 23 |

Historic Merit Increase Guidelines for Named Executive Officers (not utilized in 2020) | | | | | | | | | | | | | | | | | Personal Performance Factor | |

| Current |

|

| |

|

| |

|

| | | | Salary as a % of executive officers, with respect to compensation levels, as well as structure, are consistent with our compensation design and objectives. | | | | | | | | | | Current Salary | | Midpoint | | | 0.50–0.90 | | | 0.91–1.10 | | | 1.11–1.50 | Above Market | | | Above 105% | | | 0% | | | 0%-2% | | | 2%-5% | Market | | 95%-105% | | | 0% | | | 0%-3% | | | 4%-8% | Below Market | | Below 95% | | | 0% | | | 3%-5% | | | 6%-10% | Belden Inc. 2016 Proxy Statement | | Page 19 |

The timing and amount of any salary adjustment will be based on the executive’s annual overall performance ranking and whether the executive falls “below,” “at” or “above” market as compared to the median of the applicable market data noted above. For example, an executive with an overall ranking of “1.25” who is “above market” will receive a lower salary increase than an executive with a ranking of “1.25” who is “below market”. The named executive officers’ un-reduced salaries as of December 31, 2020 are provided in the following table. Notwithstanding the reduction in salaries from and after May 1, annual cash incentive payments and other compensation schemes that are based on a percentage of salary were measured using the unadjusted number presented below:

| V. 2015 Compensation Analysis

| A.Annual Base Salary Adjustmentsat

| Salaries of executive officers are reviewed annually and at the time of a promotion or other change in responsibilities. Increases in salary are based on a review of the individual’s performance, the competitive market, the individual’s experience and internal equity. For executives who earn a composite individual performance score of 3 or more, base salaries may be adjusted using a merit salary increase matrix, discussed below. An executive who scores less than 3 and fails to improve his or her performance may be subject to disciplinary action, including dismissal.

| The executive is scored on our merit salary increase matrix that is annually reviewed and, if appropriate, revised to reflect the competitive market based on the salary survey data noted above. The Committee reviews the merit budget and salary increase matrix. The executive’s salary is classified based on three categories: below market, market and above market. Company-wide, the ranking system is designed to take the form of a normal distribution, as follows:Name

| 1

| December 31, 2020 | | Mr. Stroup | | | $ 500,000 | | Mr. Vestjens | | | $ 750,000 | | Mr. Derksen | | | $ 584,490 | | Mr. Anderson | | | $ 381,260 | | Mr. Chand | | | $ 460,000 | | Mr. McKenna | | | $ 388,040 | | |

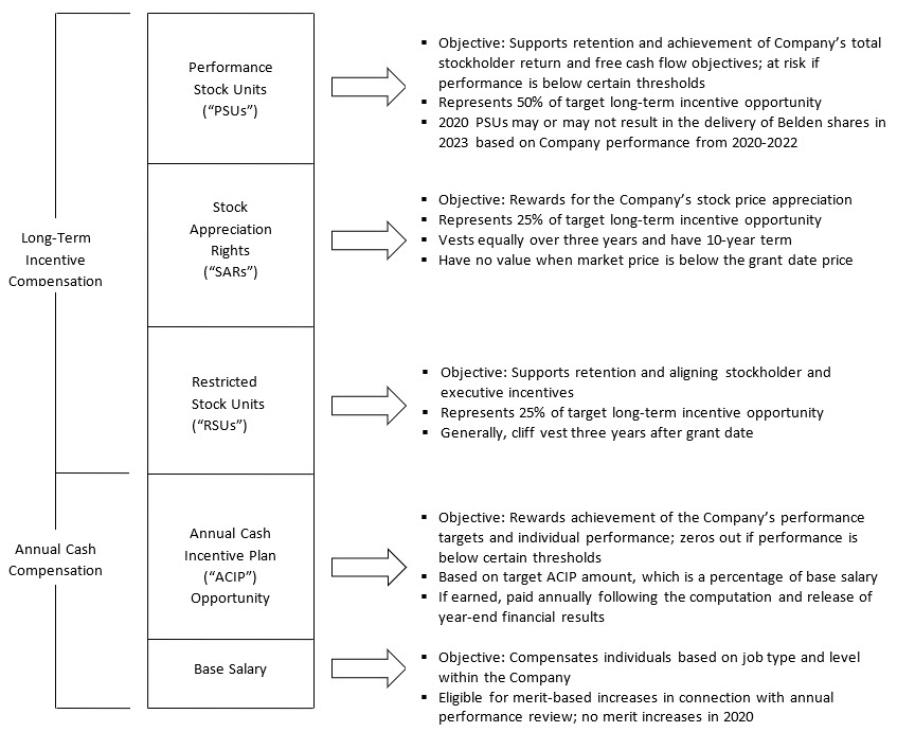

B. Annual Cash Incentive Plan Awards Executive officers participate in our annual cash incentive plan. Overall, we had 1,617 employees participate in the plan’s 2020 performance offering. Under the plan, participants earn cash awards based on the achievement of Company and individual performance goals. For 2020, the amount paid under the plan to all participants was approximately $17.912 million or approximately 9.2% of adjusted net income before ACIP expense. This compares to approximately 3.9%, 3.4%, 3.7%, and 7.8% in 2019, 2018, 2017, and 2016, respectively, as shown below: | | | | | | | | | | | | | | | | | (Dollar amounts in thousands) | | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | | Adjusted Net Income from Continuing Operations | | | $ 123,536 | | | $ 209,974 | | | $ 289,645 | | | $ 265,019 | | | $ 239,975 | | Tax effected ACIP Expense (assuming 30% rate) (a) | | | $ 12,538 | | | $ 8,562 | | | $ 10,128 | | | $ 10,145 | | | $ 20,036 | | Adjusted Net Income Before ACIP Expense (b) | | | $ 136,074 | | | $ 218,536 | | | $ 299,773 | | | $ 275,164 | | | $ 260,281 | | Reflected as a percentage (a divided by b) | | | 9.21% | | | 3.92% | | | 3.38% | | | 3.68% | | | 7.80% | | Form 8-K in which adjusted net income is reconciled to GAAP net income | | | February 10, 2021 | | | February 4, 2020 | | | February 20, 2019 | | | February 1, 2018 | | | February 2, 2017 | |

| | Page 24 | Belden Inc. 2021 Proxy Statement |

A participant’s award (other than Messrs. Stroup and Vestjens) is computed using the following formula: ACIP Award = Base Salary X Target Percentage X Financial Factor X Personal Performance Factor In 2012, based on the fact that the Chief Executive Officer’s personal performance factor (“PPF”) had consistently been equal to or greater than 1.0, the Compensation Committee removed the component from the calculation of the Chief Executive Officer’s ACIP award. The Committee desired to avoid any perception that the PPF was simply serving as a second multiplier to the CEO’s award. Given his direct reporting relationship to the Board, the Committee is comfortable that Mr. Vestjens is fully accountable without the need of the additional lever to adjust his ACIP award downward or upward. Target Percentages For 2020, each NEO’s ACIP Target Percentages were as follows: Mr. Stroup–125%, Mr. Vestjens – 130%, Messrs. Derksen and Chand–75%, Messrs. Anderson and McKenna–70%. The target percentage for Mr. Vestjens increased from 75% to 130% upon his promotion to President and CEO on May 21, 2020, and Mr. Stroup’s target percentage was reduced from 130% to 125% upon his appointment as Executive Chairman on May 21, 2020. | | Belden Inc. 2021 Proxy Statement | Page 25 |

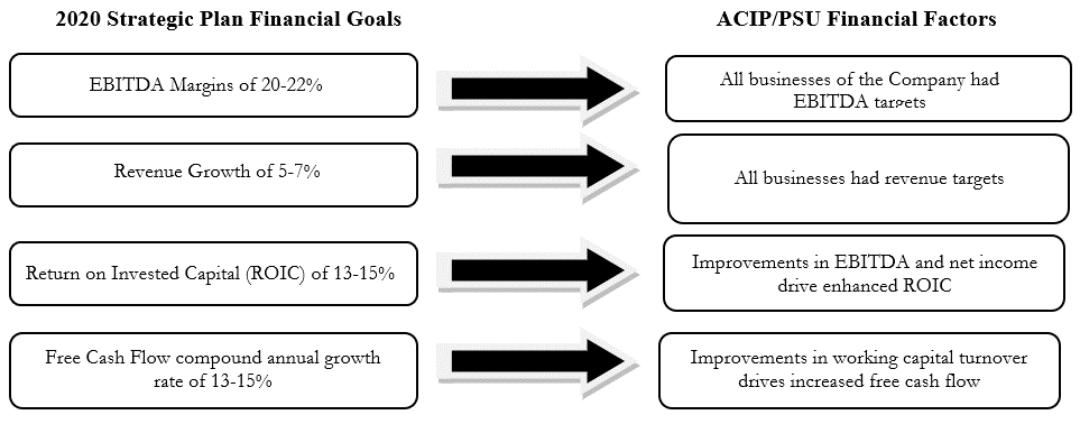

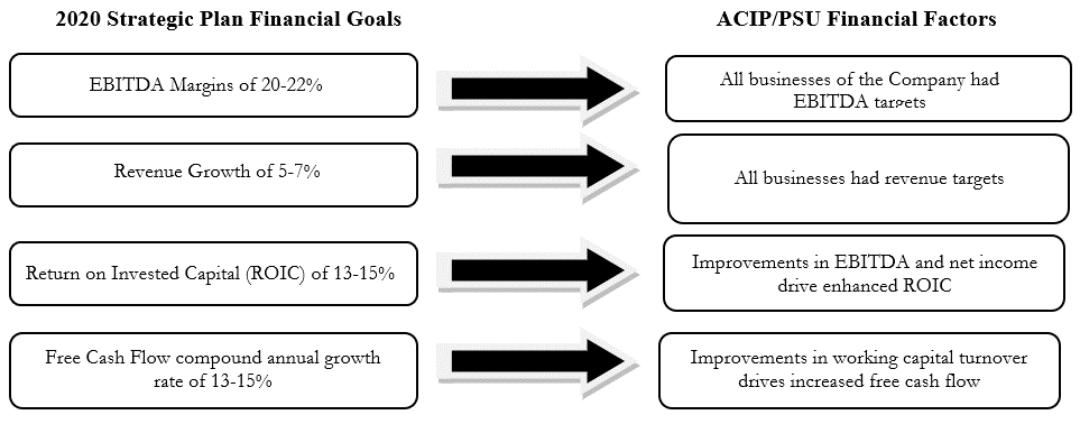

Financial Factors Performance targets for calculating the Financial Factors were based on net income from continuing operations, revenue, EBITDA, operating working capital turns and inventory turns. In addition, as discussed further below, the performance stock units (“PSUs”) had performance targets based on relative total stockholder return and free cash flow. As illustrated below, in order to ensure that we are rewarding performance that drives stockholder value, ACIP financial factors and long term equity incentive plan performance targets flow from and support the strategic financial goals we communicate to our investors.

Performance Factor Determination and Adjustments The performance factors we use that make up the Financial Factor support our short- and long-range business objectives and strategy. We have selected multiple factors because we believe no one metric is sufficient to capture the performance we are seeking to achieve and any one metric in isolation may not promote appropriate management performance. Management and the Board believe that income from continuing operations and EBITDA are the financial metrics most clearly aligned with the enhancement of stockholder value. Therefore, they are weighted heavily in our consolidated and platform targets. Additionally, revenue growth has been highlighted by our stockholders as a key component of value creation. Consistent with our Lean manufacturing philosophy, continuous improvement in inventory and working capital turnover remains a high corporate priority. In setting performance goals, we consider our annual and long-range business plans and factors such as our past variance to targeted performance, economic and industry conditions, and our industry performance. We set challenging, realistic goals that will motivate performance within the top quartile of our comparator group. We recognize that the metrics may need to change over time to reflect new priorities and, accordingly, review these performance metrics at the beginning of each performance period. In 2020, threshold, target and maximum levels for the performance factors that make up the Financial Factors were set to challenge management to achieve upper quartile performance, including with respect to consolidated revenue, consolidated net income, and consolidated EBITDA. As mentioned by the Compensation Committee in its letter earlier in this document, second-half Financial Factors were established in July of 2020 to account for changes in the macroeconomic environment that were unforeseeable when the 2020 performance factors were initially adopted. The Financial Factors for the second half of 2020 were determined using the consensus forecast of analysts covering Belden that was developed following our 2020 second quarter earnings release and analyst call. | | Page 26 | Belden Inc. 2021 Proxy Statement |

Officers with company-wide responsibilities (Messrs. Stroup, Vestjens, Derksen, Anderson and McKenna) were measured using consolidated performance. Mr. Chand, as Executive Vice President of Industrial Automation, was compensated based on the performance of the Industrial Automation segment. The applicable factors and weighting percentages are set at the beginning of each performance period as depicted below and illustrated in further detail on Appendix I. Messrs. Stroup, Vestjens, Derksen, Anderson and McKenna | | | | Factor – Least EffectiveFirst Half 2020 | | Weight | Consolidated EBITDA | | | 25% | Consolidated Revenue | | | 25% | Consolidated Working Capital Turns | | | 25% | Consolidated Net Income from Continuing Operations | | | 25% |

Factor – At least 5% of workforceSecond Half 2020 | 2

| Weight | Consolidated EBITDA | | | 25% | Consolidated Revenue | | | 25% | Consolidated Working Capital Turns | | | 25% | Consolidated Net Income from Continuing Operations | | | 25% |

Mr. Chand | | | | Factor – Needs ImprovementFirst Half 2020 | | Weight | Industrial Automation EBITDA | | | 25% | Industrial Automation Revenue | | | 25% | Industrial Automation Inventory Turns | | | 25% | Tripwire Non-renewal bookings | | | 12.5% | Tripwire EBITDA | | | 12.5% |

| | | | Factor – At least 10% of workforceSecond Half 2020 | 3 – Effective-Consistently Meets Expectations –

| Weight | Industrial Automation EBITDA | | | 50% to 70% of workforce | 4 – Highly Valued – Combined with ‘5’, no more than 15% of workforceIndustrial Automation Revenue

| 5 – Exceptional – No more than 5% of workforce

| 2015 Merit Increase Guidelines

| 25% | Industrial Automation Inventory Turns | | | 25% |

Consistent with the terms of the annual cash incentive plan, the performance factors were adjusted to reflect certain unusual events that occurred during the year. As stated above, the unprecedented macroeconomic events that occurred in 2020 required that new targets be established for the second half of the year. The Compensation Committee and the Audit Committee meet jointly to analyze and approve the adjustments recommended by management. The Committees agree that it was appropriate to adjust the financial performance targets for these matters to properly capture our operating results and to eliminate the potential for managers delaying strategic decisions beneficial to the Company in the long term (e.g., restructuring) because of the impact of those decisions on short-term financial metrics or benefitting from favorable one-time adjustments or unbudgeted events (such as acquisitions). For each individual financial performance factor, threshold, target and maximum amounts are set by the Compensation Committee. Actual performance at the threshold level is reflected with a Financial Factor score of 0.5, actual performance at the target level is reflected with a Financial Factor score of 1.0 and actual performance at or above the maximum level is reflected with a Financial Factor score of 2.0. Performance between the threshold and target and between the target and maximum are interpolated on a linear basis. Actual performance below the threshold would result in a component score of 0 and the failure to achieve at least threshold performance on the consolidated net income/segment EBITDA component would result in an overall Financial Factor of 0. Because | | Belden Inc. 2021 Proxy Statement | Page 27 |

Financial Factors are capped at 2.0 and because, as described below, he does not have a Personal Performance Factor, Mr. Vestjens ACIP payout cannot mathematically be higher than 200% of his target payout. The performance factor definitions, thresholds, targets and actual results, as well as the applicable weighting and calculations for each NEO are contained in Appendix I, which is incorporated herein by this reference. The applicable 2020 Financial Factors for the first and second halves of 2020 for the NEOs are as follows: | | | | Named Executive Officers | | | | | | | | | | | | | | | | | | | | | | Current Salary | | Current

Salary as a % of

Median | | 1 Least

Effective | | | 2 Needs

Improvement | | | 3 Effective | | | 4 Highly

Valued | | | 5 Exceptional | Above Market | | Above 105% | | | 0 | % | | | 0 | % | | | 0-2 | % | | | 2-4 | % | | 3-5% | At Market | | 95-105% | | | 0 | % | | | 0 | % | | | 0-3 | % | | | 4-6 | % | | 6-8% | Below Market | | Below 95% | | | 0 | % | | | 0 | % | | | 3-5 | % | | | 6-8 | % | | 8-10% |

The timing and amount of any salary adjustment will be based on the executive’s annual overall performance ranking and whether the executive falls “below,” “at” or “above” market as compared to the median of the applicable market data noted above.

For example, an executive with an overall ranking of “5” who is “above market” will receive a lower salary increase than an executive with a ranking of “5” who is “below market”.

The named executive officers’ salaries as of December 31, 2015 are provided in the following table:

| | | | | Name | | Annual Base Salary at

December 31, 2015 Officer | | Mr. Stroup

| | $ | 850,000 | | Mr. Derksen

| | $ | 490,740 | | Mr. Pennycook

| | $ | 360,500 | | Mr. Rosenberg

| | $ | 389,890 | | Mr. Vestjens

| | $ | 374,500 | |

| | | Page 20 | | Belden Inc. 2016 Proxy Statement |

B. Annual Cash Incentive Plan Awards

| Executive officers participate in our annual cash incentive plan. Overall, we had 1,935 employees participate in the plan’s 2015 performance offering. Under the plan, participants earn cash awards based on the achievement of Company and individual performance goals. For 2015, the amount paid under the plan to all participants was approximately $22.0 million or approximately 6.7% of adjusted net income before ACIP expense. This compares to approximately 7.7%, 7.3%, 7.2% and 8.1% in 2014, 2013, 2012 and 2011, respectively, as shown below:

| | | | | | | | | | | | (Dollar amounts in thousands) | | 2015 | | 2014 | | 2013 | | 2012 | | 2011 | Adjusted Net Income | | $213,722 | | $186,167 | | $165,139 | | $128,630 | | $114,345 | | Tax effected ACIP Expense (assuming 30% rate) (a) | | $15,400 | | $15,527 | | $12,984 | | $9,909 | | $10,084 | | Adjusted Net Income Before ACIP Expense (b) | | $229,122 | | $201,694 | | $178,123 | | $138,539 | | $124,429 | Reflected as a percentage

(a divided by b) | | 6.72% | | 7.70% | | 7.29% | | 7.15% | | 8.10% | | Form 8-K in which adjusted net income is reconciled to GAAP net income | | February 9,

2016 | | February 5,

2015 | | February 6,

2014 | | February 7,

2013 | | N/A |

A participant’s award (other than the CEO) is computed using the following formula:

ACIP Award = Base Salary X Target Percentage XFirst Half Financial Factor X Personal Performance Factor

| In 2012, based on the fact that Mr. Stroup’s personal performance factor (“PPF”) had consistently been equal to or greater than 1.0, the Compensation Committee removed the component from the calculation of Mr. Stroup’s ACIP award. The Committee desired to avoid any perception that the PPF was simply serving as a second multiplier to Mr. Stroup’s award. Given his direct reporting relationship to the Board, the Committee is comfortable that

| Mr. Stroup is accountable without the need | | 0.00 | | Mr. Vestjens | | 0.00 | | Mr. Derksen | | 0.00 | | Mr. Anderson | | 0.00 | | Mr. Chand | | 0.00 | | Mr. McKenna | | 0.00 | |

| | | | Named Executive Officer |

| Second Half Financial Factor |

| Mr. Stroup | | 1.76 | | Mr. Vestjens | | 1.76 | | Mr. Derksen | | 1.76 | | Mr. Anderson | | 1.76 | | Mr. Chand | | 1.32 | | Mr. McKenna | | 1.76 | |

Personal Performance Factor In addition to the Financial Factor, the ACIP payout for each named executive officer, other than Messrs. Stroup and Vestjens, is modified based on a Personal Performance Factor (“PPF”). As discussed above, the Committee feels that the consolidated Financial Factor is the best reflection of Messrs. Stroup’s and Vestjens’ personal performances and, thus, they do not have a separate PPF. The other NEO’s objectives are agreed upon between the NEO and Mr. Vestjens. At the end of the year, the parties measure progress relative to the objectives, as well as an assessment of how effectively the individual has lived the Company’s values during the year. Mr. Vestjens scores each NEO’s PPF on a scale of 0.50 to 1.50. The personal performance goals reflected in the Personal Performance Factor measure the attainment of short- and long-term goals that often are in furtherance of achieving objectives set out in our three-year strategic plan. Personal performance goals can be qualitative in nature and the determination of the NEO’s degree of attainment of them generally requires the judgment of Mr. Vestjens. The values scoring is, by definition, subjective based on the manager’s observations throughout the year, as well as feedback collected from others inside and outside of the organization. As a general rule, the higher in the organizational structure that one sits, the more global in scope are his or her personal objectives. Mr. Derksen, as the CFO, had objectives in the areas of talent management, information technology and investor relations performance, but also focused other objectives on areas specific to the finance function, e.g., accounting, tax and capital structure. As global functional leads Messrs. Anderson and McKenna had objectives that connected them to the corporate priorities of stockholder value enhancement, customer satisfaction and sustainable employee engagement. As an Executive Vice President of Belden’s Industrial Automation business, the objectives of Mr. Chand were supportive of goals of the Company’s industrial businesses. His objectives related to the areas of growth, both organic and inorganic, talent management and operational excellence through the continued institution of Lean enterprise principles. The 2020 Personal Performance Factors for the NEOs as recommended by Mr. Vestjens and approved by the Committee ranged from 1.00 to 1.24. | | Page 28 | Belden Inc. 2021 Proxy Statement |

Annual Cash Incentive Plan Payouts Based on the preceding discussion, each NEO’s annual cash incentive plan award is as shown in the table below. The awards were paid out following adoption of the Financial Factors and Personal Performance Factors by the Committee in February 2021. | | | |

| 2020 ACIP Award | NEO | | ($) | Mr. Stroup | | 550,000 | Mr. Vestjens | | 858,000 | Mr. Derksen | | 385,763 | Mr. Anderson | | 258,342 | Mr. Chand | | 287,930 | Mr. McKenna | | 282,059 |

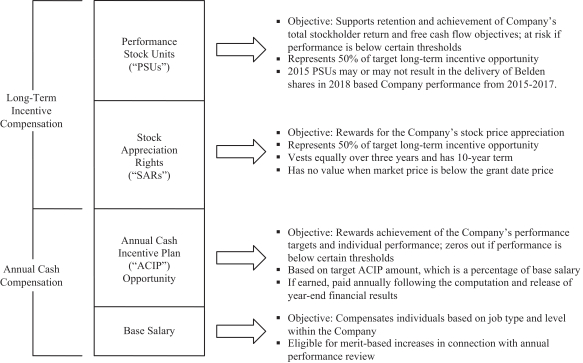

C. Long Term Incentive Awards Our long-term equity incentive plan is designed to align the financial interests of our executives and our stockholders by providing executives with a continuing stake in the long-term success of the company. With at least 75% of each executive officer’s (other than Mr. Stroup) LTI grant made up of SARs that have value only if Belden’s stock price increases and PSUs that only convert into Belden shares if certain performance metrics are achieved, the plan emphasizes our Pay-for-Performance. For 2020, executive officers other than Mr. Stroup received 50% of their LTI award (discussed below) under the plan in the form of PSUs, 25% in the form of SARs and 25% in the form of RSUs. Mr. Stroup’s LTI was awarded as 50% PSUs and 50% RSUs. Individual performance, the competitive market, executive experience and internal equity were factors used to determine the total dollar value of SARs, RSUs and PSUs granted to each executive officer in 2020, which we refer to as the “Long-Term Incentive Value”, or “LTI Value”. LTI Value Each executive is assigned a target LTI value (expressed as a % of base salary) based on the factors described above. We then use the following matrix to determine actual grant size as a % of target: | | | | | | | PPF | | 0.85 – 1.15 | | | 1.16 – 1.50 | | Percentage of the additional lever to adjust his ACIP award downward or upward. Target PercentagesLTI For 2015, each NEO’s ACIP Target Percentages were as follows: Mr. Stroup – 130%, Mr. Derksen – 75% and Messrs. Pennycook, Rosenberg and Vestjens – 70%.

| 70% – 120% | | | | Belden Inc. 2016 Proxy Statement | | Page 21 |

Financial Factors

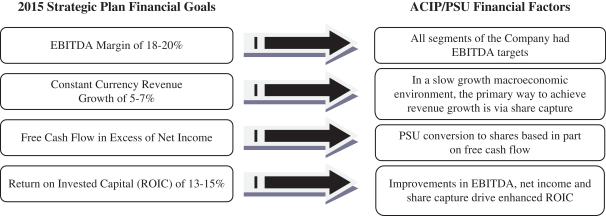

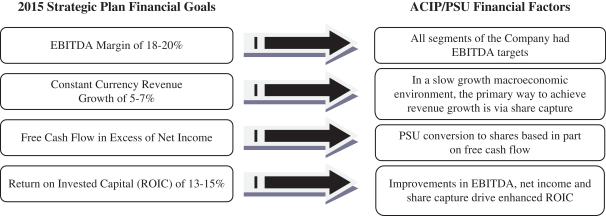

As stated above, performance targets for calculating the Financial Factors were based on net income from continuing operations, EBITDA, share capture, operating working capital turns and inventory turns. In addition, as discussed further below, the performance stock units (“PSUs”) had performance targets based on relative total stockholder return and free cash flow. In order to ensure that we are rewarding performance that drives stockholder value, these factors flow from and support the strategic financial goals we communicate to our investors.

Performance Factor Determination and Adjustments

The performance factors we use that make up the Financial Factor support our short- and long-range business objectives and strategy. We have selected multiple factors because we believe no one metric is sufficient to capture the performance we are seeking to achieve and any one metric in isolation may not promote appropriate management performance. Management and the Board believe that income from continuing operations and EBITDA are the financial metrics most clearly aligned with the enhancement of stockholder value. Therefore, they are weighted heavily in our consolidated and platform targets. Additionally, share capture continues to be an important measure of our performance versus our competitors. And despite the maturity of our development from a Lean manufacturing standpoint, continuous improvement in inventory and working capital turnover remains a high corporate priority.

In setting performance goals, we consider our annual and long-range business plans and factors such as our past variance to targeted performance, economic and industry conditions, and our industry performance. We set challenging, realistic goals that will motivate performance within the top quartile of our comparator group based on consensus data on the peer companies publicly available at the time the targets are set. We recognize that the metrics may need to change over time to reflect new priorities and, accordingly, review these performance metrics at the beginning of each performance period.

In 2015, thresholds, targets and maximum levels for the performance factors that make up the Financial Factors were set to challenge management to grow the company in a low growth environment. For instance, the 2015 target for consolidated net income from continuing operations reflected a 30% increase over actual 2014 performance. Likewise, the consolidated share capture target represented an almost 68% improvement over actual 2014 performance. Targets for the business platforms reflected similar stretch improvement initiatives. While platform performance on EBITDA and working capital/inventory turns did not fully meet our expectations, outperformance on share capture was achieved at the platform and consolidated levels. We view this as a positive result of our Belden Market Delivery System.

| | 100% – 190% | | Page 22 | | Belden Inc. 2016 Proxy Statement |

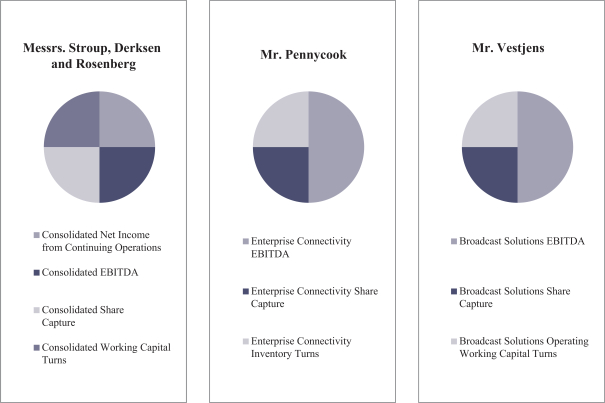

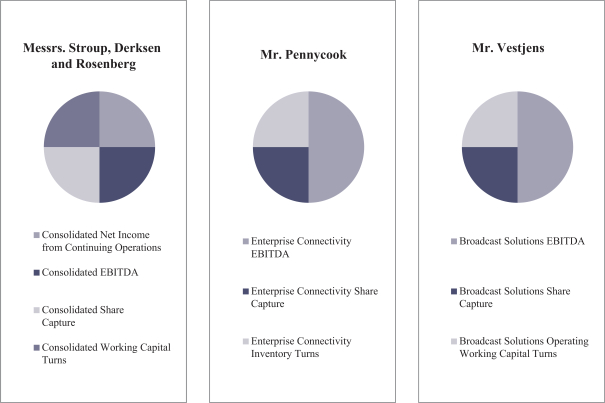

Officers with company-wide responsibilities (Messrs. Stroup, Derksen and Rosenberg) were measured using consolidated performance. Mr. Pennycook and Mr. Vestjens were compensated based on the performance of the Enterprise Connectivity Solutions and Broadcast Solutions platforms, respectively. The applicable factors and weighting percentages are set prior to each performance period as shown in the chart below and illustrated in further detail onAppendix I.

Consistent with the terms of the annual cash incentive plan, the performance factors were adjusted to reflect certain unusual events that occurred during the year. These adjustments can result in either increases or decreases in performance factors and in 2015 primarily concerned amortization of intangible assets, deferred gross profit adjustments, restructuring of the Company’s operations, purchase accounting effects of acquisitions, depreciation expense, as well as the income tax impact of these adjustments. The Compensation Committee and the Audit Committee meet jointly to analyze and approve the adjustments recommended by management. The Committees agree that it was appropriate to adjust the financial results for these matters to properly capture our operating results and to eliminate the potential for managers delaying strategic decisions beneficial to the Company in the long term (e.g., restructuring) because of the impact of those decisions on short-term financial metrics or to benefit from favorable one-time adjustments or unbudgeted events (such as acquisitions).

For each individual performance factor, threshold, target and maximum amounts are set by the Compensation Committee. Actual performance at the threshold level is reflected with a Financial Factor score of 0.5, actual performance at the target level is reflected with a Financial Factor score of 1.0 and actual performance at or above the maximum level is reflected with a Financial Factor score of 2.0. Performance between the threshold and target and between the target and maximum are interpolated on a linear basis. Actual performance below the threshold would result in a component score of 0 and the failure to achieve at least threshold performance on the net income/operating income component would result in an overall Financial Factor of 0. Because Financial Factors are capped at 2.0 and because, as described below, he does not have a Personal Performance Factor, Mr. Stroup’s ACIP payout cannot mathematically be higher than 200% of his target payout.

|

| | | Belden Inc. 2016 Proxy Statement | | Page 23 |

The performance factor definitions, thresholds, targets and actual results, as well as the applicable weighting and calculations for each NEO are contained inAppendix I, which is incorporated herein by this reference. The applicable 2015 Financial Factor for the NEOs is as follows:

An officer did not receive an equity award in 2020 if his or her 2019 Personal Performance Factor was less than 0.85. Mr. Stroup does not have a target LTI percentage or a Personal Performance Factor. At its February 2020 meeting, the Compensation Committee awarded Mr. Stroup LTI with a grant date fair value of approximately $5.0 million. Messrs. Derksen and Vestjens each had a Target LTI percentage of 160% of their respective base salaries while Messrs. Anderson, Chand and McKenna each had a Target LTI percentage of 120% of their respective base salaries. Mr. Vestjens was not awarded additional LTI upon his promotion to President and Chief Executive Officer. | | | Named Executive Officer | | Financial Factor | Mr. Stroup

| | 0.99 | Mr. Derksen

| | 0.99 | Mr. Pennycook

| | 1.35 | Mr. Rosenberg

| | 0.99 | Mr. Vestjens

| | 0.91 |

Personal Performance Factor

Each named executive officer other than Mr. Stroup establishes annual personal performance objectives. As discussed above, the Committee feels that the consolidated Financial Factor is the best reflection of Mr. Stroup’s personal performance and, thus, he does not have a separate Personal Performance Factor (“PPF”

To illustrate the LTI Value matrix, assume a base salary of $400,000 and a Target LTI percentage of 50%. The Target LTI Value is $200,000. Assuming the officer’s PPF is 1.0, he or she would receive equity valued between $140,000 and $240,000. If the same officer’s PPF is 1.20, he or she would receive equity valued between $200,000 and $380,000. The exact amount granted within the range for each individual is at the discretion of the individual’s immediate supervisor (the “LTI Award”). The other NEO’s objectives are agreed upon between the NEO and Mr. Stroup. At the end of the year, the parties measure progress relative to the objectives. Mr. Stroup scores each NEO’s PPF on a scale of 0.5 to 1.5. The personal performance goals reflected in the Personal Performance Factor measure the attainment of short- and long-term goals that often are in furtherance of achieving objectives set out in our three-year strategic plan. Personal performance goals can be qualitative in nature and the determination of the NEO’s degree of attainment of them generally requires the judgment of Mr. Stroup.

As a general rule, the higher in the organizational structure that one sits, the more global in scope are his or her personal objectives. Mr. Derksen, as the CFO, had objectives in the areas of talent management, and information technology and investor relations performance, but also focused other objectives on areas specific to the finance function, e.g., accounting, tax and capital structure. As the chief strategy officer, Mr. Rosenberg had objectives relating to the Company’s M&A funnel and integration, as well as talent management and other strategic objectives. As the EVPs of two of Belden’s product platforms, the objectives of Messrs. Pennycook and Vestjens were supportive of the Company’s global goals, but focused within their respective business units. Their objectives related to the areas of growth, both organic and M&A, talent management and operational excellence through the continued institution of Lean enterprise principles in their respective business units.

The 2015 Personal Performance Factors for the NEOs as recommended by Mr. Stroup and approved by the Committee ranged from 1.00 to 1.15.

Annual Cash Incentive Plan Payouts

Based on the preceding discussion, each NEO’s annual cash incentive plan award is as shown in the table below. The awards were paid out in February 2016 following adoption of the Financial Factors and Personal Performance Factors by the Committee.

| | | | | | | | NEO | | 2015 ACIP Award(1) | | | Percentage of Target | John Stroup | | $ | 1,093,950 | | | 99.0% | Henk Derksen | | $ | 382,590 | | | 103.9% | Glenn Pennycook | | $ | 391,770 | | | 155.2% | Ross Rosenberg | | $ | 270,190 | | | 99.0% | Roel Vestjens | | $ | 238,560 | | | 91.0% |

(1) | For administrative convenience, the final payouts are rounded to the nearest ten dollar amount. |

| | | Page 24 | | Belden Inc. 2016 Proxy Statement |

C. Performance-Based Equity Awards

Our long-term equity incentive plan is designed to align the financial interests of our executives and our stockholders by providing executives with a continuing stake in the long-term success of the company. With grants of SARs that have value only if Belden’s stock price increases and PSUs that only convert into Belden shares if certain performance metrics are achieved, the plan emphasizes Pay-for-Performance. For 2015, executive officers received 50% of their LTI award (discussed below) under the plan in the form of SARs and 50% in the form of PSUs.

Individual performance, the competitive market, executive experience and internal equity were factors used to determine the total dollar value of SARs and PSUs granted to each executive officer in 2015, which we refer to as the “Long-Term Incentive Value”, or “LTI Value”.

LTI Value

We use the following matrix to determine the LTI as a percentage of base salary for each officer:

| | | | | PPF

| | 0.85 – 1.15 | | 1.16 – 1.50 | Percentage of Target LTI

| | 70% – 120% | | 100% – 190% |

An officer did not receive an equity award in 2015 if his or her 2014 Personal Performance Factor was less than 0.85. Mr. Stroup does not have a target LTI percentage or a Personal Performance Factor. At its February 2015 meeting, the Compensation Committee awarded Mr. Stroup LTI valued at approximately $3.75 million, or approximately 441% of base salary. Mr. Derksen has a Target LTI of 160% while Messrs. Pennycook, Rosenberg and Vestjens each have a Target LTI percentage of 120% of their respective base salaries.

To illustrate the LTI value matrix, assume a base salary of $200,000 and a Target LTI percentage of 50%. The Target LTI is $100,000. Assuming the officer’s PPF is 1.0, he or she would receive equity valued between $70,000 and $120,000. If the same officer’s PPF is 1.20, he or she would receive equity valued between $100,000 and $190,000. The exact amount granted within the range for each individual is at the discretion of the individual’s immediate supervisor (the “LTI Award”)

For 2015, the NEOs received 50% of their LTI Award in the form of SARs and 50% in the form of PSUs.

As previously discussed, the NEOs other than Mr. Stroup received 50% of their LTI Award in the form of PSUs, 25% in the form of SARs and 25% in the form of RSUs. We use the Black-Scholes-Merton (“Black-Scholes”) option pricing formula to calculate SAR values. Instead of using the grant date stock price as the input in the Black-Scholes formula, we use a one-year average price of the stock (the “Average Belden Stock Price”). That same price is utilized to determine the number of PSUs granted. | | Belden Inc. 2021 Proxy Statement | Page 29 |

In summary, the LTI Award is allocated into the number of units resulting from the following formulas: PSUs = 50% of the LTI Award divided by the Average Belden Stock Price, rounded to the nearest unit. SARs = 25% of the LTI Award divided by the Black-Scholes value of a Belden SAR, rounded to the nearest unit. RSUs = 25% of the LTI Award divided by the Average Belden Stock Price, rounded to the nearest unit. Half of the PSUs granted in 2020 will be measured based on total stockholder return (TSR) relative to the S&P 1500 Industrials Index. The other half of the PSUs will be measured based on cumulative consolidated free cash flow, as adjusted for certain restructuring expenses in connection with acquisition integration and other changes to the Company. The PSU agreements state that following the three-year performance period, a conversion factor ranging from 0 to 2.0 will be applied to each award. The result of that formula, rounded to the nearest whole unit, is the gross number of Belden shares the officer will receive. The actual number of shares to be distributed will be net of any required withholding taxes. The PSUs granted in 2020 will be measured on the performance period from February 11, 2020 (the grant date) to December 31, 2022, in the case of the TSR-based PSUs, and January 1, 2020 to December 31, 2022, in the case of the free cash flow-based PSUs. The conversion and any resulting payout will occur in the first quarter of 2023. Conversion will be effected based on threshold, target and maximum levels. For the PSUs based on relative TSR, threshold performance results in a conversion factor of 0.25, target performance results in a conversion factor of 1.00 and maximum performance results in a conversion factor of 2.00. Performance between threshold and target and between target and maximum are interpolated on a linear basis. For the PSUs based on consolidated free cash flow, threshold performance results in a conversion factor of 0.50, target performance results in a conversion factor of 1.00 and maximum performance results in a conversion factor of 2.00. Performance between threshold and target and between target and maximum are interpolated on a linear basis. The SARs provide a material incentive for executives to increase the Company’s share price during their ten-year term, and they serve as a retention tool because they take three years to fully vest. The PSUs drive performance against targets during the three-year performance period, as PSUs will not convert to Belden shares if performance thresholds are not achieved (as was the case in 2021 for PSUs granted in 2018). RSUs provide executives with an interest in the company designed to align the interest of the executives and stockholders, and they also serve as a retention tool because they cliff vest only after the passage of time, normally three years. At its February 2020 meeting, the Compensation Committee approved equity award grants in the form of 149,401 SARs, 187,599 PSUs and 102,439 RSUs to 210 employees. The Compensation Committee also approved equity award grants to Messrs. Derksen and Anderson upon the successful completion of the divestiture of the Company’s Live Media business. In May 2020, in the face of unprecedented uncertainty resulting from the COVID-19 pandemic, the Compensation Committee approved a temporary reduction in the salaries payable to certain Belden associates, including each of the NEOs, through December 31, 2020. In place of the forfeited salary compensation, on July 1, 2020 the Compensation Committee granted each affected Belden Associate an amount of time-vested RSUs equal in value at the time of the grant to the value of the forfeited salary compensation. These RSUs vest in 1/3 increments on each anniversary of July 1, 2020. In August 2020, to account for changes to the global macroeconomic environment since the 2019 and 2020 PSUs were granted, the Compensation Committee approved a modification of the performance criteria applicable to the 2019 and 2020 free cash flow PSUs. For reporting purposes, those PSUs are accounted for in the Summary Compensation Table and Grants of Plan Based Awards Table that follow, as an additional grant of PSUs in August of 2020. The table below shows the total 2020 grants of SARs, PSUs and RSUs to the named executive officers. | | Page 30 | Belden Inc. 2021 Proxy Statement |

2020 Equity Awards to NEOs | | | | | | | | | NEO | | SARs(1) | | | PSUs | | | RSUs | Mr. Stroup | | — | | | 46,218 | | | 51,623 | Mr. Vestjens | | 10,825 | | | 7,857 | | | 11,149 | Mr. Derksen | | 11,462 | | | 8,319 | | | 10,691 | Mr. Anderson | | 6,368 | | | 4,622 | | | 7,618 | Mr. Chand | | 9,297 | | | 6,748 | | | 6,266 | Mr. McKenna | | 6,368 | | | 4,622 | | | 4,648 |

| (1) | The Committee granted the listed SARs to the NEOs at the closing price of Belden stock on February 11, 2020 ($51.14), the grant date stock price as the input in the Black-Scholes formula, we use a one-year average price of the stock (the “Average awards. |

2018-2020 PSU Grant Beginning in 2015, the Company moved from a one-year performance measurement period to a three-year performance measurement period for its PSUs. The three-year performance measurement period for PSUs granted in 2018 ended on December 31, 2020. At its February 2021 meeting, the Compensation Committee certified a conversion ratio of 0 for both types of PSUs granted in 2018, resulting in each NEO receiving no shares of Belden stock in connection with this grant. The threshold, target, maximum and actual performance are shown below: | | | | | | | | | | | | | | | | | Factor | | | Threshold | | | | Target | | | | Maximum | | | | Actual | | Relative TSR | | | 25th Percentile | | | | 50th Percentile | | | | 75th Percentile | | | | 7th Percentile | | Consolidated Free Cash Flow | | | 738,000,000 | | | | 923,000,000 | | | | 1,108,000,000 | | | | 504,000,000 | |

Free cash flow is defined as net cash provided by operating activities, adjusted for certain acquisition and divestiture transaction costs and capital expenditures, plus the proceeds from the disposal of tangible assets. At certain times in each of 2018 and 2019, the Compensation Committee granted a special long-term incentive award comprised of 50% time-vested RSUs and 50% performance-based PSUs (the “Supplemental Incentive Plan”) to Messrs. Vestjens, Derksen, Anderson and McKenna. The time-vested RSUs will cliff-vest on the four-year anniversary of the grant date. The performance-based PSUs will be earned based on relative TSR performance compared to the S&P 1500 Industrials index from the grant date to the third anniversary of the grant date, with any earned awards subject to an additional one-year vesting period. The Compensation Committee has rarely granted this type of special stock award and generally confines equity grants to the regular compensation program for its executives. In this case, however, the Compensation Committee determined that it was appropriate to make this special award to retain and incentivize key executives. No such Supplemental Incentive Plan Awards were granted in 2020. However, on February 11, 2020, the Compensation Committee awarded Messrs. Derksen and Anderson $100,000 RSU awards that would be granted upon the successful completion of the divestiture of the Company’s Live Media business. Messrs. Derksen and Anderson were granted such awards on July 2, 2020 that cliff vest on July 2, 2023. In connection with his departure from the Company as of March 12, 2021, Mr. Derksen received accelerated vesting of the awards described in this paragraph. VI. Compensation Policies and Other Considerations Stock Ownership Guidelines To align their interests with those of the Company’s stockholders, the Company’s executive officers must hold stock with value of at least three times their annual base salary (six times in the case of Messrs. Stroup and Vestjens). Officers have five years from the date they are appointed as an officer or promoted to acquire the appropriate shareholdings. In addition, officers must make interim progress toward the ownership requirement during the five year period – 20% after one year, 40% after two years, 60% after three years and 80% after four years. For purposes of determining ownership, unvested RSUs and the value of vested but unexercised, in-the-money options and SARs are included. For calculation purposes, the Company uses the higher of the current trading price or the | | Belden Stock Price”). That same price is utilized to determine the number of PSUs granted. In summary, the LTI Award is allocated into the number of units resulting from the following formulas:Inc. 2021 Proxy Statement | SARs = 50% of the LTI Award divided by the Black-ScholesPage 31

|

acquisition price. As of March 29, 2021 (our record date for the annual meeting), each of the named executive officers other than Mr. McKenna either met his interim or five-year stock ownership guideline. In accordance with Company policy, an officer is prohibited from selling Belden stock until the officer meets the applicable guideline. Tax and Accounting Considerations Section 162(m) of the Internal Revenue Code of 1986, as amended, precludes the Company from taking a federal income tax deduction for compensation paid in excess of $1 million to our “covered employees” (which included the CEO and our three other most highly-compensated executive officers, other than the Chief Financial Officer, for years prior to 2018 and now includes all NEOs, including the CFO). Prior to 2018, this limitation did not apply to “performance-based” compensation. While the Compensation Committee has generally attempted to maximize the tax deductibility of executive compensation, the Compensation Committee believes that the primary purpose of our compensation program is to support the Company’s business strategy and the long-term interests of our shareholders. Therefore, the Compensation Committee has maintained the flexibility to award compensation that may not be tax deductible if doing so furthers the objectives of our executive compensation program. Under the December 2017 U.S. tax reform, the exception to Section 162(m) for performance-based compensation was repealed for tax years beginning after December 31, 2017, subject to certain transition and grandfathering rules. Despite these new limits on the deductibility of performance-based compensation, the Compensation Committee continues to believe that a significant portion of our named executive officers’ compensation should be tied to the Company’s performance. Therefore, it is not anticipated that the changes to Section 162(m) will significantly impact the design of our compensation program going forward. Annual non-equity based incentive compensation and PSUs for our Named Executive Officers are unguaranteed, subject to maximum payout amounts based on the achievement of the performance objectives established by the Compensation Committee annually. These objectives are selected by the Compensation Committee from among the performance metrics in the annual incentive plan for non-equity based compensation and the long term incentive plan for the PSUs. The Compensation Committee may exercise discretion to adjust the award based on an assessment of Company and individual performance. Also, our compensation plans comply with the requirements of Internal Revenue Code Section 409A, which requires that nonqualified deferred compensation arrangements must meet specific requirements. In accordance with FASB ASC Topic 718, for financial statement purposes, we expense all equity-based awards over the period earned based upon their estimated fair value at grant date. Executive Compensation Recovery In accordance with the Sarbanes-Oxley Act of 2002, the CEO and the CFO must forfeit certain bonuses and profits if the Company is required to restate its financial statements as a result of misconduct. In addition, if the Board of Directors determines that any other executive officer has engaged in fraudulent or intentional misconduct that results in the Company restating its financial statements because of a material inaccuracy, the Company, as permitted by law, will seek to recover any cash incentive compensation or other equity-based compensation (including proceeds from the exercise of a stock option or SAR) received by the officer from the Company during the 12-month period following the first public issuance or filing with the SEC of the financial statement required to be restated. The Company will revisit its clawback policies once the proposed rules issued by the SEC implementing the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) are finalized. Insider Trading; Hedging and Pledging of Company Stock Company policy requires executive officers and directors to consult the Company’s legal department prior to engaging in transactions involving Belden stock. In order to protect the Company from exposure under insider trading laws, executive officers and directors are encouraged to enter into pre-programmed trading plans under Securities Exchange Act Rule 10b5-1. The Company will not approve hedging or monetization transactions including, but not limited to, through the use of financial instruments such as exchange funds, prepaid variable forwards, equity swaps, puts, calls, collars, forwards and other derivative instruments, or through the establishment of a short position in the Company’s securities. Executive officers and directors are prohibited from utilizing margin accounts to engage | | Page 32 | Belden SAR, rounded to the nearest unit.Inc. 2021 Proxy Statement |

in transactions in Belden stock and from pledging Belden stock for any purpose. Such restrictions do not apply to non-executive officer employees. Equity Compensation Grant Practices The Compensation Committee approves all grants of equity compensation, including stock appreciation rights, performance stock units and restricted stock units, to executive officers of the Company, as defined in Section 16 of the Exchange Act. All elements of executive officer compensation are reviewed by the Compensation Committee annually at a first quarter meeting. Generally, the Company’s awards of stock appreciation rights, performance stock units and/or restricted stock units are made at that meeting, but may be made at other meetings of the Compensation Committee. The Compensation Committee meeting date, or the next business day if the meeting falls on a non-business day, is the grant date for stock appreciation rights and restricted stock unit awards. The Company may also make awards in connection with acquisitions or promotions, or for retention purposes. Under the Company’s equity plan, the Compensation Committee may delegate to the Company’s CEO the authority to grant stock options to any employees of the Company other than executive officers of the Company as that term is defined in Section 16 of the Exchange Act. The Compensation Committee has exercised this authority and delegated to the CEO the ability to make limited equity grants in connection with promotion, retention and acquisitions, which he uses strategically but infrequently. Awards made by the CEO are reported to the Compensation Committee on a periodic basis. Severance, Termination and Retirement In 2020, the Company and the NEOs (other than Mr. Stroup, who maintained an employment agreement with no severance obligations outside of a change of control) agreed to terminate each NEO’s existing employment contract. In place of the severance provisions of the employment agreements, the Company’s executive officers are participants in the Belden 2020 Executive Severance Plan (the “Severance Plan”), which establishes a specified severance program that will govern the benefits, if any, offered to an executive officer following the conclusion of his or her employment by the Company. We believe that the Company’s Severance Plan is essential in attracting and retaining the desired executive talent in a competitive market. In addition, the Severance Plan benefits the Company by providing for the upfront agreement of each executive on certain important provisions, including post-termination covenants and an agreement to provide a full release of claims against the Company. Information regarding benefits under the Severance Plan is provided following this Compensation Discussion and Analysis under the heading Potential Payments upon Termination or Change of Control. Aircraft The Company owns and from time to time leases corporate aircraft to provide flexibility to executive officers and other associates to allow more efficient use of executive time for Company matters. The Nominating and Corporate Governance Committee reviews management’s use of corporate aircraft throughout the year to confirm that it is consistent with this philosophy and in full compliance with the regulations promulgated by the Federal Aviation Administration, the Internal Revenue Service and the Securities and Exchange Commission. Benefits and Perquisites The named executive officers receive retirement and health care benefits on a consistent basis with other Belden employees. As described in Pension Benefits and Nonqualified Deferred Compensation, excess defined benefit and defined contribution plans are offered to eligible U.S. employees. In order to attract and retain talented officers, we have provided certain other compensation to our NEOs. It is our policy to not provide tax gross-ups for any perquisites provided to executive officers other than in extraordinary circumstances, as was the case in 2020 to ensure that Mr. Chand's relocation from Hong Kong to the San Francisco area was economically neutral for him. PSUs = 50% of the LTI Award divided by the Average

| | Belden Stock Price, rounded to the nearest unit.Inc. 2021 Proxy Statement Half of the PSUs granted in 2015 will be measured based on total stockholder return (TSR) relative to the S&P 1500 Industrials Index. The other half of the PSUs will be measured based on cumulative consolidated free cash flow. The PSU agreements state that following the three-year performance period, a conversion factor ranging from 0 to 2.0 will be applied to each award. The result of that formula, rounded to the nearest whole unit, is the gross number of Belden shares the officer will receive. The actual number of shares to be distributed will be net of any required withholding taxes. The PSUs granted in 2015 will be measured on the performance period from January 1, 2015 to December 31, 2017, and the conversion and any required payout will occur in the first quarter of 2018.

Conversion will be effected based on the following threshold, target and maximum levels:

| | | | | | Page 33 | Factor

| | Threshold | | Target | | Maximum | Relative TSR

| | 25th Percentile | | 50th Percentile | | 75th Percentile | Consolidated Free Cash Flow

| | $672 million | | $840 million | | $1,008 million |

|

| | | Belden Inc. 2016 Proxy Statement | | Page 25 |

For the PSUs based on relative TSR, threshold performance results in a conversion factor

Report of 0.25, target performance results in a conversion factor of 1.00 and maximum performance results in a conversion factor of 2.00. Performance between threshold and target and between target and maximum are interpolated on a linear basis. For the PSUs based on consolidated free cash flow, threshold performance results in a conversion factor of 0.50, target performance results in a conversion factor of 1.00 and maximum performance results in a conversion factor of 2.00. Performance between threshold and target and between target and maximum are interpolated on a linear basis.

The SARs provide a material incentive for executives to increase the Company’s share price during their ten-year term, and they serve as a retention tool because they take three years to fully vest. The PSUs drive performance against targets during the three-year performance period.

At its February 2015 meeting, the Compensation Committee approved equity award grants in the form of 223,506 SARs, 90,817 PSUs and 62,862 RSUs to over 375 employees. The table below shows the total 2015 grants of SARs and RSUs to the named executive officers.

2015 Equity Awards to NEOs

| | | | | | NEO | | SARs(1) | | PSUs | Mr. Stroup | | 62,672 | | 25,407 | Mr. Derksen | | 13,370 | | 5,420 | Mr. Pennycook | | 6,351 | | 2,575 | Mr. Rosenberg | | 7,521 | | 3,049 | Mr. Vestjens | | 8,356 | | 3,388 |

(1) | The Committee granted the listed SARs to the NEOs at the closing price of Belden stock on February 25, 2015 ($89.23), the grant date of the awards. |

Pay for Performance in Action

As of December 31, 2015, based on the stock price performance in 2015 after the February 25 grant date, the SARs reflected above have no value and the PSUs based on relative TSR would not convert to any shares. Similarly, the PSUs based on consolidated free cash flow would not convert to any shares. In reviewing theSummary Compensation Table that follows, it is important to note that the approximately $7.5 million of value shown in the Stock Awards and Option Awards columns for 2015 currently have no value. In order to create value for themselves, the members of the management team must create value for our stockholders. We believe this is a true reflection of the alignment between our pay and our performance.

VI. Compensation Policies and Other Considerations

Stock Ownership Guidelines

To align their interests with those of the Company’s stockholders, the Company’s executive officers must hold stock whose value is at least three times their annual base salary (six times in the case of Mr. Stroup). Officers have five years from the date they are appointed an officer to acquire the appropriate shareholdings. In addition, officers must make interim progress toward the ownership requirement during the five year period – 20% after one year, 40% after two years, 60% after three years and 80% after four years. For purposes of determining ownership, unvested RSUs and the value of vested but unexercised, in-the-money options and SARs are included. For calculation purposes, the Company will use the higher of the current trading price or the acquisition price. As of March 31, 2016 (our record date for the annual meeting), each of the named executive officers either met his interim or five-year stock ownership guideline. In accordance with Company policy, an officer is prohibited from selling Belden stock received from the Company as an equity award until the officer meets the interim guideline.

| | | Page 26 | | Belden Inc. 2016 Proxy Statement |

Tax and Accounting Considerations

Section 162(m) of the Internal Revenue Code of 1986, as amended, imposes a $1 million limit on the amount that a public company may deduct for compensation paid to the Company’s CEO or any of the Company’s other NEOs who are employed as of the end of the fiscal year. This limitation does not apply to compensation that meets the requirements under Section 162(m) for “qualifying performance based” compensation (i.e., compensation paid only if performance meets pre-established objective goals based on performance criteria approved by stockholders). The Company’s incentive compensation plans are designed to qualify under Internal Revenue Code Section 162(m) to ensure tax deductibility. However, the Committee retains the flexibility to design and administer compensation programs that are in the best interests of Belden and its stockholders.

Annual non-equity based incentive compensation and PSUs for our Named Executive Officers are unguaranteed, subject to maximum payout amounts based on the achievement of the Section 162(m) performance objectives established by the Committee annually. These objectives are selected by the Committee from among the performance metrics in the annual incentive plan for non-equity based compensation and the long term incentive plan for the PSUs.See Item IV, beginning on page 42 for a broader discussion of the long term incentive plan performance metrics. The Committee may exercise “negative discretion” to reduce the award based on an assessment of Company and individual performance. For 2015, the Committee awarded less than the maximum amount. Also, our compensation plans comply with the requirements of Internal Revenue Code Section 409A, which requires that nonqualified deferred compensation arrangements must meet specific requirements.

In accordance with FASB ASC Topic 718, for financial statement purposes, we expense all equity-based awards over the period earned based upon their estimated fair value at grant date.

Executive Compensation Recovery

In accordance with the Sarbanes-Oxley Act of 2002, Mr. Stroup, as CEO, and Mr. Derksen, as CFO, must forfeit certain bonuses and profits if the Company is required to restate its financial statements as a result of misconduct. In addition, if the Board of Directors determines that any other executive officer has engaged in fraudulent or intentional misconduct that results in the Company restating its financial statements because of a material inaccuracy, the Company, as permitted by law, will seek to recover any cash incentive compensation or other equity-based compensation (including proceeds from the exercise of a stock option or SAR) received by the officer from the Company during the 12-month period following the first public issuance or filing with the SEC of the financial statement required to be restated. The Company will revisit its clawback policies once the proposed rules issued by the SEC implementing the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) are finalized.

Insider Trading; Hedging and Pledging of Company Stock

Company policy requires executive officers and directors to consult the Company’s legal department prior to engaging in transactions involving Belden stock. In order to protect the Company from exposure under insider trading laws, executive officers and directors are encouraged to enter into pre-programmed trading plans under Securities Exchange Act Rule 10b5-1. The Company will not approve hedging or monetization transactions including, but not limited to, through the use of financial instruments such as exchange funds, prepaid variable forwards, equity swaps, puts, calls, collars, forwards and other derivative instruments, or through the establishment of a short position in the Company’s securities. Executive officers and directors are prohibited from utilizing margin accounts to engage in transactions in Belden stock and from pledging Belden stock for any purpose. The Company will revisit its trading policies once the proposed rules issued by the SEC implementing the Dodd-Frank Act are finalized.

Equity Compensation Grant Practices

The Committee approves all grants of equity compensation, including stock appreciation rights, performance stock units and restricted stock units, to executive officers of the Company, as defined in Section 16 of the Exchange Act. All elements of executive officer compensation are reviewed by the Committee annually at its February/March meeting. Generally, the Company’s awards of stock appreciation rights, performance stock

| | | Belden Inc. 2016 Proxy Statement | | Page 27 |

units and/or restricted stock units are made at that meeting, but may be made at other meetings of the Committee. The Committee meeting date, or the next business day if the meeting falls on a non-business day, is the grant date for stock appreciation rights and restricted stock unit awards. The Company may also make awards in connection with acquisitions or promotions, or for retention purposes. Under the Company’s equity plan, the Committee may delegate to the Company’s CEO the authority to grant stock options to any employees of the Company other than executive officers of the Company as that term is defined in Section 16 of the Exchange Act. The Committee has exercised this authority and delegated to the CEO the ability to make limited equity grants in connection with promotion, retention and acquisitions, which he uses strategically but infrequently. Awards made by the CEO are reported to the Committee on a periodic basis.

Employment Agreements: Severance, Termination and Retirement

The Company has an employment agreement with each of the named executive officers. We believe that our agreements are essential in attracting and retaining the desired executive talent in a competitive market. In addition, the agreements benefit the Company by providing for the upfront agreement of each executive on certain important provisions, including post-termination covenants and an agreement to provide a full release of claims against the Company. These agreements address key provisions of the employment relationship, including payment of severance benefits upon a termination of employment before and after a change of control of the Company. Beginning in 2010, new executive employment agreements no longer contain a gross-up to compensate the executives for an Internal Revenue Code Section 280G excise tax. Instead the executives are given the option of either (a) collecting their full severance and paying the excise tax themselves with no assistance from the Company or (b) reducing the severance payments to an amount that prevents the excise tax from being imposed. Information regarding benefits under these agreements is provided following this Compensation Discussion and Analysis under the headingPotential Payments upon Termination or Change of Control.

Aircraft

The Company owns and from time to time leases corporate aircraft to provide flexibility to executive officers and other associates to allow more efficient use of executive time for Company matters. The Nominating and Corporate Governance Committee reviews management’s use of corporate aircraft throughout the year to confirm that it is consistent with this philosophy and in full compliance with the regulations promulgated by the Federal Aviation Administration, the Internal Revenue Service and the Securities and Exchange Commission.

Benefits and Perquisites

The named executive officers receive retirement and health care benefits on a consistent basis with other Belden employees. As described inPension Benefits andNonqualified Deferred Compensation, excess defined benefit and defined contribution plans are offered to eligible U.S. employees. In order to attract and retain talented officers, we have provided certain other compensation to our NEOs. In connection with an expatriate assignment in Hong Kong that ended in 2014, Mr. Vestjens was, by agreement, entitled to tax equalization, including a gross-up to make him whole financially. Other than this limited exception, it is our policy to not provide tax gross-ups for any perquisites provided to executive officers.

Report of the Compensation Committee

The Compensation Committee has reviewed and discussed with management the foregoing Compensation Discussion and Analysis section of this proxy statement. Based on such review and discussion, the Compensation Committee recommended to the Board of Belden that the Compensation Discussion and Analysis be included in the proxy statement. | | | Compensation Committee | | | | David Aldrich (Chair) | | Lance Balk | Steve Berglund

Glenn Kalnasy

| | Jonathan Klein | Page 28 | | Belden Inc. 2016 Proxy Statement |

Compensation and Risk We consider the variable, pay-for-performance components of our compensation programs to assess the level of risk-taking these elements may create. The variable components of our compensation programs offered to management (including our executives) are our annual cash incentive plan and long term incentive awards program. We believe the way we select and set performance goals and targets with multiple levels of performance; using gradually-sloped payout curves that do not provide large payouts for small incremental improvements; and confirming the achievement of performance before issuing the awards, all reduce the potential for management’s excessive risk-taking or poor judgment. Consistent with sound risk management, we limit the annual cash incentive award by capping the financial factor component at two times the target, as well as capping the awards themselves at the lesser of three times target or $5 million. The long-term incentive is limited through the use of a fixed percentage of the participant’s base salary. In addition, we require that executive officers adhere to stock ownership guidelines to promote a long-term focus and have adopted a compensation recovery policy in the event of fraudulent or intentional misconduct that leads to a restatement of our financial results. We also consider our variable compensation programs offered to other associates. These are primarily incentive programs offered to sales and marketing associates. We believe the way we administer these programs reduces the potential of their causing a material adverse impact on the Company through excessive risk-taking. We have customer contract practices with respect to operating margins, customer creditworthiness, and channel management that are designed to reduce poor judgment in connection with entering into sales contracts having unreasonable terms. Sales targets are not designed to provide large payouts that are either based on small incremental improvement or overly aggressive goals that could induce excessive risk-taking by the salesperson. These programs are monitored throughout the performance period to ensure they are being properly administered. The results are subject to multiple levels of approval, including through the involvement of internal and external audit resources. Pay Ratio Disclosure In accordance with its rulemaking responsibilities related to the Dodd-Frank Act, the Securities and Exchange Commission has adopted a rule that requires annual disclosure of the ratio of the median Company employee’s total annual compensation to the total annual compensation of the Company’s principal executive officer. Though Mr. John Stroup and Mr. Roel Vestjens each served as the Company’s principal executive officer during 2020, for the purposes of determining the ratio of the median Company employees total annual compensation to the compensation of the Company’s principal executive officer, the Company’s principal executive officer is Roel Vestjens, President and Chief Executive Officer as of the time the median employee was calculated. Belden’s median employee was determined by reviewing the cash compensation paid to all Belden employees worldwide¸ excluding certain de minimis jurisdictions under item 402(u) of Regulation S-K, but including Belden employees based in countries where the cost of living and average salaries in the market are substantially lower than the United States, from January 1, 2020 through December 31, 2020. Once the median employee was identified, the calculation of annual total compensation for that median employee was determined in the same manner as the “Total Compensation” shown for Mr. Vestjens in the Summary Compensation Table contained herein.

Page 34 | Belden Inc. 2021 Proxy Statement | |